WIP Setup Overview

The setup for processing WIP is determined by settings in the Projects Setup, Project Card, Project Posting Groups, Fixed Project Line Budget, and General Components. The fields and options are described in this topic.

WIP Basis

The WIP Basis defines on which level WIP is calculated. The selection in the Default WIP Basis field in the Projects Setup page is defaulted to the Project Card. The options in this field are:

Sales Code – Each project line with a Sales Code is handled separately for the WIP calculation. This is the default.

WIP Position – Individual positions in the Project Budget Calculation are used in the WIP calculation. Similar to the Rollup Type on Project Budget Calculation lines, the lower positions are summarized to a higher level. For example, if a machine was used in the calculation but is not sold in total but in parts, then the machine position will be set for WIP calculation and the lower levels will be summarized to the machine position.

Project – The entire project is summarized in the WIP calculation, the Project line structure is not considered. On a separate position in the Project Budget Calculation, the WIP View checkbox must be selected either:

- through a Fixed Project Line Budget with the WIP View checkbox selected (see Fixed Project Lines Budget).

- by entering a general component that is specified as a WIP Component (see General Components).

WIP Methods

The WIP Method determines how WIP is calculated using different formulas. The WIP Method is defined in the Project Cards but can be defaulted from the Project Posting Group assigned to the Project. The options for the WIP Method are described in the following sections.

Cost Value and Cost of Sales

When the WIP Method is set to Cost Value or Cost of Sales, the WIP including Impending Losses and Prospective Cost is calculated as follows:

- WIP is calculated based on actual cost until expected cost or expected sales are reached, depending on the setting in the WIP Max. Cost Range field in the Project Posting Groups page.

- Impending Losses are calculated when expected costs are higher than expected sales. It will be cancelled if expected sales are completely invoiced. Partial invoicing will cancel Impending Losses partially.

- Prospective Cost is calculated when the actual cost is smaller than revenue-adjusted cost. It will be cancelled if expected cost is equal to actual cost or expected cost is evaluated with zero cost.

Impending Losses are calculated even if there are no Usage Total Cost and the Expected Total Cost are higher than Expected Total Price.

Formula: Impending Losses (LCY) = Expected Total Cost – Expected Total Price

Provisions for Impending Losses and Prospective Cost are calculated as follows:

Impending Losses

- Calculated since impending losses are identified

- Also at the beginning of a project

Prospective Cost

- Calculated since revenue has reached expected sales

- Also if expected costs are higher than expected sales

Example

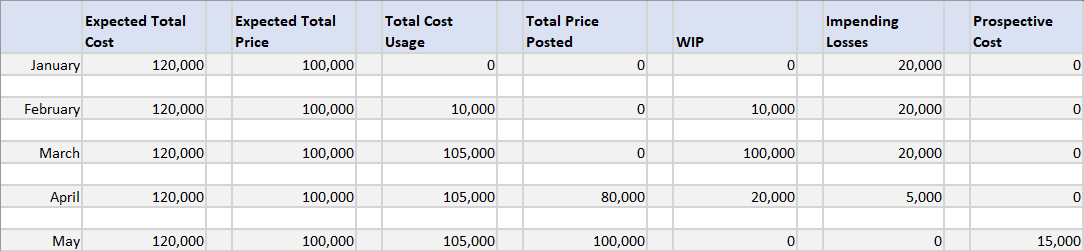

A project has expected costs and prices to use WIP processing between January and May. During this time, usage and invoices are posted to the project. The WIP calculation with Impending Losses and the Prospective Cost is displayed in the following table.

The WIP processing per date is described as follows:

- January – Project starts; because expected total costs are higher than expected total price, the impending Losses are calculated.

- February – Project in progress; expected values have not changed, but usage total cost was recognized which results in WIP. Impending Losses still exist.

- March – Project in progress; expected values have not changed, but usage total cost has exceeded expected total price. The result is that only maximum costs of expected total price are allowed to be recognized as WIP. Impending Losses still exist.

- April – Project in progress; expected values have not changed, but now sales invoices have been posted. This results in reduction of WIP and reduction of Impending Losses.

- May – Project almost completed; expected values have not changed, but total price posted reached expected total price. This results in cancellation of the WIP value and Impending Losses; it recognizes that expected total cost is still higher than usage total cost, which results in Prospective Cost.

At the very end, if no more costs are expected, the Prospective Cost will be cancelled.

Sales Value

The WIP Method = Sales Value option is similar to the Cost Value/Cost of Sales options but uses a different formula.

- WIP is calculated based on actual cost until expected sales are reached. The formula is Total Cost (Usage) - Posted Sales Amount - WIP Adm./Sales %.

- Impending Losses are calculated when expected costs are higher than expected sales. It will be cancelled if expected sales are completely invoiced. Partial invoicing will cancel Impending Losses partially.

- Prospective Cost is calculated when the actual cost is smaller than revenue-adjusted cost. It will be cancelled if expected cost is equal to actual cost or expected cost is evaluated with zero cost.

Percentage of Completion

The WIP Method = Percentage of Completion is based on the expected cost and is calculated using this formula: Expected Amount * Realized % - WIP Revenue-based (LCY)

The calculation of the Expected Amount and WIP Revenue-based (LCY) amount is different based on the value in the WIP Max. Cost Range field in the Project Posting Groups.

Expected Amount

- Cost Amount – Expected costs are calculated

- Sales Amount – Expected sales are calculated

WIP Revenue-based (LCY)

- Cost Amount – WIP is calculated using this formula: Total Price Posted * Expected Costs / Expected Sales

- Sales Amount – WIP is calculated using this formula: Total Price Posted - WIP Adm./Sales %

Completed Contract

The WIP Method = Completed Contract is handled like the WIP Method = Cost Value. However, with the Complete Contract method, costs and revenues are realized with the completed project. This is helpful if estimates of costs and revenues are uncertain.

The setup for this method is managed in the Project Posting Groups page.

The Default WIP Method field must be set to Completed Contract and the following standard Microsoft Dynamics 365 Business Central G/L Account fields must be populated:

- WIP Invoiced Sales Account – posted revenue

- WIP Costs Account – posted usage

- Project Costs Applied Account – usage balance account

- Project Sales Applied Account – revenue balance account

Note

An error message will occur when running the Calculate WIP function if these G/L Accounts are not set up for Default WIP Method = Completed Contract.

WIP Calculation

The following calculations are used with the Default WIP Method = Completed Contract:

Impending Losses will be calculated even if there are no usage costs and the expected cost are higher than expected sales.

Formula: Impending Losses (LCY) = Expected Total Cost – Expected Total Price

The WIP Max. Cost Range will be considered based on the selected option in the request page:

- If Cost Amount, the WIP costs account is limited to the Expected Total Cost.

- If Sales Amount, the WIP costs account is limited to the Expected Total Price.

Prospective Costs (LCY) are not calculated within this WIP Method.

WIP Inv. Sales Amount (LCY) will be calculated based on posted revenue.

When the project Status is changed to Completed, the G/L Accounts will be reversed to zero, depending on the setting in the Auto. Reverse WIP field in Projects Setup (see Projects FastTab).

Example

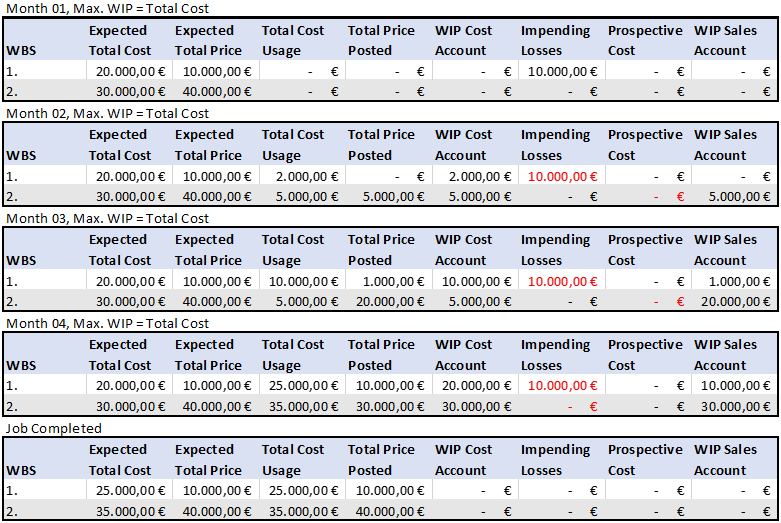

This table is an example of the calculation using the WIP Method = Completed Contract. Over a four-month period, expected and actual usage and revenue is posted to a project.

The WIP calculations with WIP Method = Completed Contract are described as follows:

- Month 01 – Project has started; because expected total costs are higher than expected total price in WBS 1., Impending Losses are calculated.

- Month 02 – Project is in progress; expected values have not changed, but usage total costs were recognized which result in WIP Cost Account. Impending Losses still exist for WBS 1. For WBS 2., posted sales were recognized which result in WIP Sales Account.

- Month 03 – Project is in progress; expected values have not changed, but usage total costs were recognized which result in WIP Cost Account. Impending Losses still exist for WBS 1. Also, additional posted sales were recognized which result in WIP Sales Account.

- Month 04 – Project is in progress; expected values have not changed, but usage total costs were recognized which result in WIP Cost Account until the WIP Max. Cost range definition. Impending Losses still exist for WBS 1. Also, additional posted sales were recognized which result in WIP Sales Account.

- Month 05 – Project has been completed; expected values have been updated and all WIP values have been cancelled.

See Also

Project Card

Project Posting Groups

Feedback

Submit feedback for this page .